ALERUS FINANCIAL (ALRS)·Q4 2025 Earnings Summary

Alerus Beats on Strategic Repositioning, Adjusted ROTCE Hits 21%

January 29, 2026 · by Fintool AI Agent

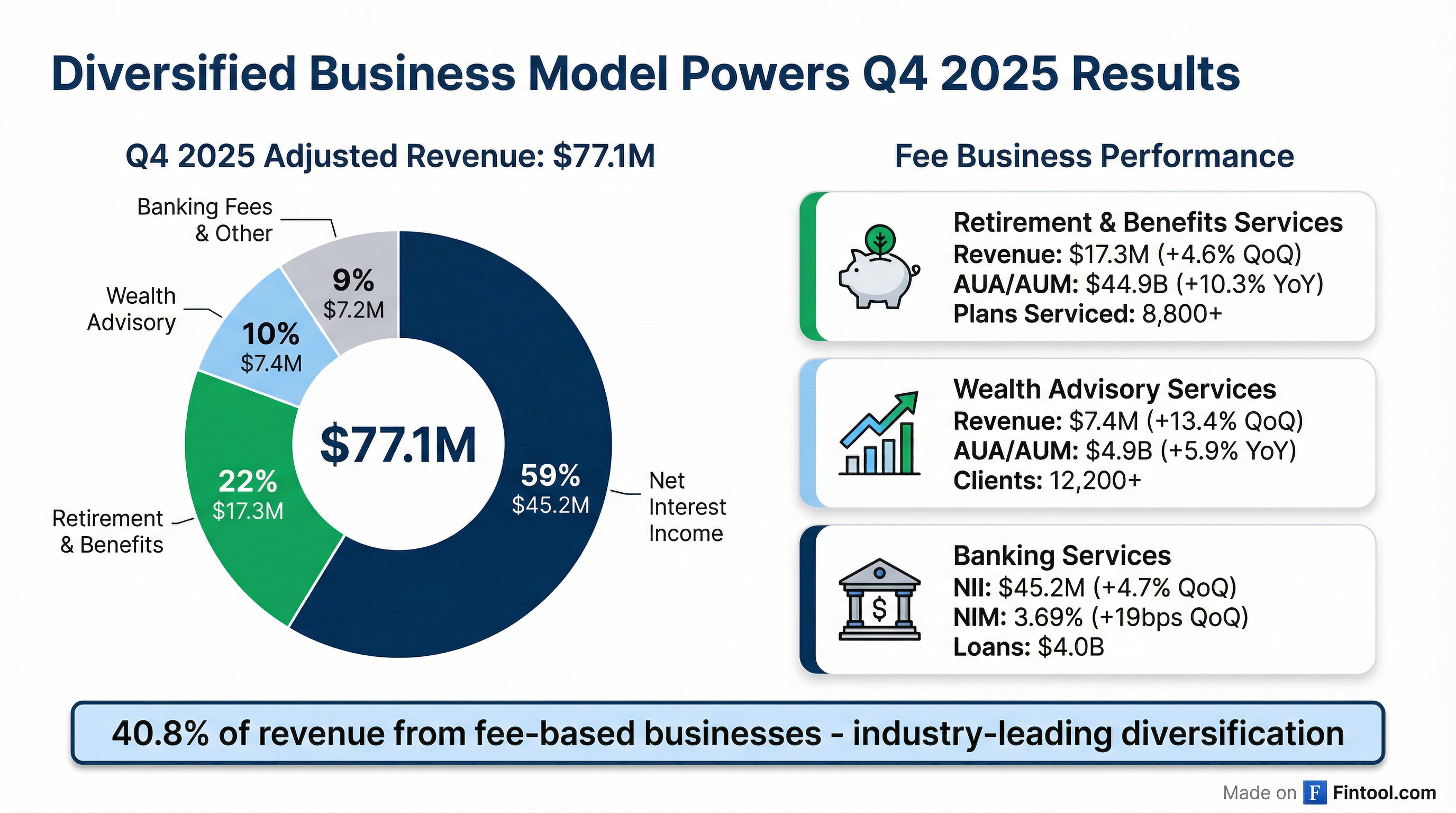

Alerus Financial Corporation (NASDAQ: ALRS) delivered a strong Q4 2025, beating consensus on both revenue and earnings despite a headline GAAP loss driven by strategic balance sheet repositioning. The commercial wealth bank and national retirement plan provider reported adjusted EPS of $0.85, up 29% sequentially, as net interest margin expanded to 3.69% and fee businesses continued their growth trajectory.

The quarter's standout story: Alerus completed a $360 million securities repositioning, selling low-yielding legacy assets (1.7% average yield) and reinvesting at 4.7% — a move that drove a $68.4M pre-tax loss but positions the bank for meaningfully higher profitability in 2026 and beyond.

Did Alerus Beat Earnings?

Yes — Alerus beat on both top and bottom line:

The GAAP net loss of $(33.1)M or $(1.27) per share reflects the one-time securities loss. On an adjusted basis, the quarter showed substantial improvement across all key metrics.

Quarterly Performance Trend (Adjusted EPS):

Four consecutive quarters of positive adjusted earnings since the HMNF acquisition closed, with Q4 2025 representing the strongest quarter in the post-merger period.

What Drove the Quarter?

Net Interest Income: $45.2M (+4.7% QoQ, +18.0% YoY)

Net interest margin expanded 19 basis points to 3.69%, driven by:

- Lower funding costs: Cost of total deposits fell 17bps to 2.18%

- One-time benefit: $2.4M adjustment related to a sold loan participation

- Purchase accounting: 52bps of accretion from HMNF acquisition

New business spreads remain exceptionally strong: loans pricing at 258bps over Fed funds while deposits at 116bps below Fed funds, yielding a 374bps new business margin.

Fee-Based Revenue: $31.9M Adjusted (+8.3% QoQ)

Alerus's diversified model delivered again, with fee income representing 41% of adjusted revenue — well above regional bank peers.

Retirement & Benefit Services: $17.3M (+4.6% QoQ)

- AUA/AUM grew to $44.9B (+10.3% YoY)

- 8,800+ employer-sponsored retirement plans

- 60% of revenue tied to plans/participants (less market-sensitive)

Wealth Advisory: $7.4M (+13.4% QoQ)

- AUA/AUM reached $4.9B (+5.9% YoY)

- Asset-based fees drove outperformance

What Did Management Guide?

CEO Katie Lorenson and CFO Al Villalon provided FY 2026 guidance that implies continued profitable growth:

Management's commentary emphasized operating leverage. Notably, guidance assumes no Fed cuts — each 25bp cut would add ~5bps to NIM.

How Did the Stock React?

The stock closed at $23.80 on January 28, then traded up to $24.05 (+1.1%) in after-hours trading following the earnings release.

Stock Performance Context:

The muted reaction likely reflects the market already anticipating the balance sheet repositioning, which was strategically announced with the results.

What Changed From Last Quarter?

Balance Sheet Repositioning

The headline change was the $360M securities sale — the most significant strategic action since the HMNF acquisition:

Capital Position Strengthened

Tangible book value grew 21.5% YoY ($14.44 → $17.55), driven by AOCI improvement as securities losses were realized.

Credit Quality Remains Pristine

Second consecutive quarter of net recoveries ($0.3M), and the company recorded a $0.3M provision release.

Key Management Quotes

CEO Katie O'Neill Lorenson on strategic positioning:

"2025 was a defining year for Alerus. In our first full year integrating the HMN Financial, Inc. acquisition, we exceeded our financial performance expectations with an adjusted return on average assets of 1.35% and adjusted efficiency ratio of 64.45%."

On the balance sheet repositioning:

"Our strategic balance sheet repositioning removed the drag of legacy low-yielding securities, and positions Alerus for higher profitability in 2026 and beyond."

On capital and shareholder returns:

"Our disciplined focus on shareholder value translated into tangible book value growth of 21.54% from the prior year, supported by a fourth quarter adjusted return on average tangible equity of 21.05%."

Risks and Concerns

-

CRE Concentration: Total non-owner occupied and multifamily CRE loans remain elevated at 251% of bank risk-based capital, though management is actively reducing exposure.

-

Deposit Competition: Total deposits declined 5% QoQ as the company called brokered CDs and reduced high-cost wholesale funding. LTD ratio rose to 96.6% (vs. 95-96% target). Management described deposit competition as "very competitive" across all markets with continued shift from non-interest bearing to interest bearing.

-

NIM Sustainability: The 52bps of purchase accounting accretion and one-time items will fade over time, though the securities repositioning should partially offset this.

-

NPLs Trending Higher: Nonperforming loans to total loans increased to 1.63% from 1.45% in Q3, requiring monitoring.

Forward Catalysts

- Q1 2026 Earnings: Full-quarter benefit of securities repositioning should flow through NII

- Fed Policy: Further rate cuts could pressure NIM but benefit fee businesses

- M&A Optionality: With integration complete and capital strengthened, Alerus has capacity for strategic acquisitions

- Dividend Growth: Current yield ~3.5% with payout well-covered by adjusted earnings

Q&A Highlights

The earnings call Q&A provided additional color on management's 2026 playbook:

Core Margin Trajectory

CFO Al Villalon clarified that the core NIM (ex-accretion) was 3.17% in Q4 versus the reported 3.69%. Purchase accounting accretion of 52bps contributed to the headline figure. For 2026, accretion drops ~60% to approximately $8M (~$2M/quarter) from ~$20M in 2025, meaning core margin improvement must replace this tailwind.

"A good exit rate right now is looking at the 3.17% that we had in the fourth quarter and growing it from that." — CFO Al Villalon

Loan Growth Drivers

Chief Banking Officer Jim Collins attributed the mid-single digit loan growth outlook to 70% market disruption/talent lift-outs and 30% economic growth. The bank is actively pivoting from CRE to full C&I relationships:

"We want full relationships. We don't want orphan credits... We're paring down our CRE, we're building up C&I." — Jim Collins

Wealth Advisor Expansion

Management confirmed plans to significantly expand the wealth business, with 26 advisors currently and plans to add 6-7 more in 2026 across key markets (Twin Cities, Phoenix, Wisconsin):

"We will take the opportunity to add talent where we find it... we are actively recruiting in all markets." — Jim Collins

Credit Resolution Timeline

COO Karin Taylor addressed the non-accrual uptick, confirming multiple non-performers expected to resolve in H1 2026. The largest exposure — a $32M Twin Cities multifamily — now has multiple offers and is 74% leased with a 17% reserve. A smaller acquired multifamily with a 15% reserve should "resolve relatively quickly."

Capital Allocation Priorities

CEO Katie Lorenson confirmed capital priorities in order: organic growth, team lift-outs, dividends, buybacks, and M&A — with retirement/HSA acquisitions remaining a strategic priority:

"We continue to expand and deepen the conversations that we're in with potential partners [in retirement and HSA space]." — CEO Katie Lorenson

Additional 2026 Guidance Details

- Tax rate: 24%

- Loan-to-deposit ratio target: 95-96%

- Rate sensitivity: Each 25bp Fed cut adds ~5bps to NIM

- Deposit competition: Described as "very competitive" across all markets

Summary

Alerus delivered a clean beat in Q4 2025, with the strategic balance sheet repositioning setting up a stronger 2026. The diversified business model continues to differentiate, with fee income at 41% of revenue providing stability. Management's execution on the HMNF integration — adjusted ROTCE of 21.05%, TBV growth of 21.5%, and efficiency improvement to 63.55% — validates the acquisition thesis. The Q&A reinforced themes of core NIM expansion replacing accretion, C&I-focused loan growth, and aggressive wealth advisor hiring. CFO Al Villalon's bullish closing:

"While we showed the underlying potential of this better and bigger company in 2025, 2026 is about continued improvement of our core businesses to drive returns higher. So get on the bus and buy some Alerus."

Related: